In all phases of a company transaction BERCON Consulting Group provide you with Professional skills and specific practical experience. With the BERCON 5 step method you will utilise our systematic approach to the successful acquisition or sale of companies and corporate shares, spin off´s, spin on´s, MBO, MBI, or private equity and capital partnerships.

Step 1: Determination of requirements / profiling

-

Definition of strategic and operational targets ( branch, market segment, investment, profitability etc.)

-

Development of necessary detail criteria and specific key points ( sales, cost structures, products, customer, distribution)

-

Forecasting the total assignment, acquisition or sales process, project management and expected time-frame

-

Preparation of an investor memorandum or sales report / exposé

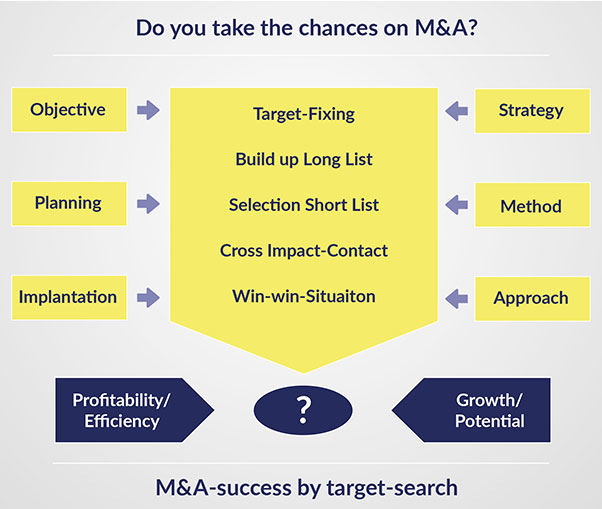

Step 2: Selection of potential buyers and sellers / equity partners

-

- With data bank research, market analysis and cross impact methods potential candidates will be identified. To filter the right buyer or seller it requires a focused and prioritized selection of different firms and segment groups.

By using the specific BERCON-M & A target search, respective candidates and suitable buyers / sellers can be efficiently exhausted.

Step 3: Presentation of candidates and starting negotiations

-

- Initial candidate contacts through BERCON allow the client to retain anonymity, as is normaly desired. General interests and individual reasons for buying or selling will be considered carefully.

The potential candidates will be based on level of interest transferred from the long list into a short list. After agreement with the candidates on the important key points, the negotiations will be started in detail. BERCON assists in all the difficult and complex parts of the negotiation to advance the deal to its successful completion.

Step 4: Due diligence, company valuations and price finding

-

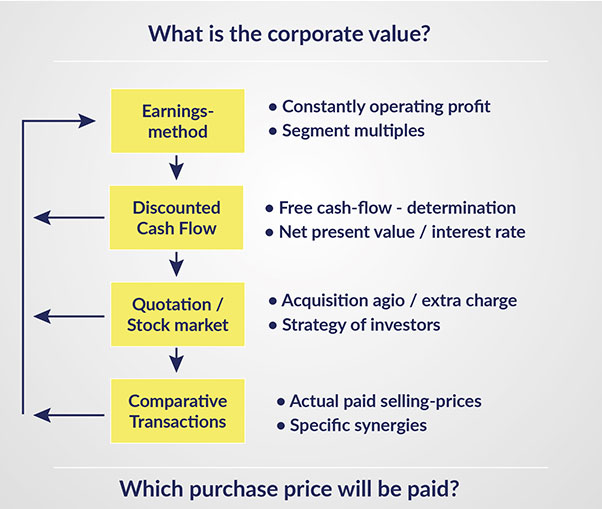

- Various scientific valuation methods can be used in order to calculate the company value as a whole. However, there can only be one solution in the end: The price that can be accepted from both sides.

With BERCON´s support, both buyer and seller will reach a fair price. By using the BERCON industry-factors and segment-mutiples, price margins can be defined that are suitable for all transaction parties with regard to pricing, basic data, amounts started and detailed coordination.

Step 5: Agreement on the contract and closing phase

- During the negotiations BERCON advises on all critical tansaction issues. This happens in close coordination with all involved parties, such as certified public accounts, lawyers, tax experts, etc. Additionaly suggestions for financial engineering will be submitted, if required. BERCON enjoys excellent relationships with leading private equity groups, banks or other investment partners. With the specific know-how of BERCON Consulting group the transaction will be intensively supported from the first inspection until the finally agreement / take over contract.

To Learn more about our innovative services, please contact us.

Deutsch

Deutsch English

English